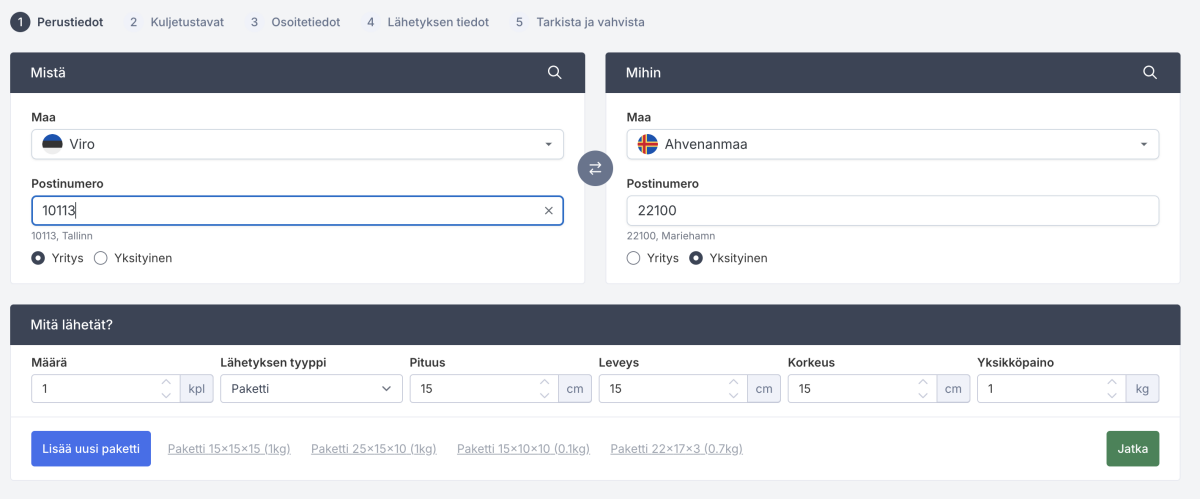

When sending a parcel to Åland Islands, please note that you need to select Åland as the destination country instead of Finland. Below is an example of how to get prices for shipments to Åland. The postal code format for Åland is the same five-digit format as in Finland:

When sending a package to Åland through Shipit, you can use the following Matkahuolto and Posti services: Postal Package, Small Package, Home Delivery Package, Posti Express, Posti Freight, Matkahuolto's Nearby and XXS packages.

However, there are exceptions when sending to Åland compared to domestic Finnish package traffic, because Åland belongs to the EU but not to the EU tax territory.

As a private individual, sending a package to Åland is easy. You can create a proforma invoice for gifts or create a commercial invoice for commercial shipments.

If you have paid VAT on the shipment to customs and want to return the shipment, you must submit form 971s to Mariehamn customs within 3 months of the order.

VAT is also charged on freight, using the same percentage as the product itself.

Additional information for companies trading between Finland and Åland

When selling products to Åland, you must sell at 0% VAT, otherwise the Åland recipient will have to pay double VAT. Private individuals cannot reclaim VAT if it has been charged both at purchase and upon arrival of goods (exception: if the sender has an Åland tax border number).

From July 1st, VAT is charged on all transport. Additionally, clear package markings are required on address labels or waybills, which we will cover in the section below.

Export declarations are not required for postal shipments if the value does not exceed 1000 euros.

Starting January 1st, 2023, Posti charges a ferry surcharge for deliveries to Åland. The ferry surcharge applies to business customers who have a contract with Posti and send packages to Åland. The ferry surcharge is €5.50 per shipment.

Important points about changes and markings on transport documents

Clear description of goods, e.g., just "shirt" is not sufficient.

Total weight of goods

Buyer's name, address, and Business ID + "VAT REG" marking (not used for natural persons registered in the VAT register whose business is not related to import). Sender's Business ID must also be included in sender information.

Transport document markings: buyer's name, business ID + "VAT REG" marking, or seller's or transport company's tax border number are mutually exclusive alternatives in the declaration.

A commercial invoice must be used when goods are delivered to a person not registered for VAT or to a natural person registered for VAT whose business is not related to import, and when an indirect representative's tax border number is not used in the import.

New required information is added to Sender and Recipient fields when either party is in Åland.

If information is incorrectly marked, a separate clarification fee may be charged. Read more detailed information on Customs website. For Matkahuolto shipments, the clarification fee is €24 per shipment.

Åland companies must have a tax border number when sending goods to Finland. Finnish companies sending packages to Åland should also obtain one. Please note that when sending goods to Åland, VAT must be removed from the invoice before shipping. The same applies when sending outside the EU. In other words, exports are tax-free.

More information about tax border numbers and Åland's special status.

Note! When sending a postal package to a private individual in Åland and the value exceeds the tax threshold, the private individual must pay a €3 handling fee to the local Post Office. The same applies to taxable shipments from Åland to Finland.

We recommend verifying current information if needed from: Mariehamn Customs tel. 0295 52 333 or email atp.skattegrans(at)tulli.fi