Commercial and Proforma Invoices

are used for shipments outside the EU to declare the purpose of the shipment to the shipping company and local customs authorities. These are used to determine the customs value of the shipment and any customs-related procedures at both sending and receiving ends.

Please note that almost all shipping companies require a commercial or proforma invoice in advance to ensure the shipment can reach its destination outside the EU.

Document shipments (DOCS) can move freely outside the EU and do not require a commercial invoice. Document shipments have a weight limit that varies by shipping company, after which they are classified as package shipments. Samples are considered goods shipments even if they fit in a document envelope.

Commercial Invoice

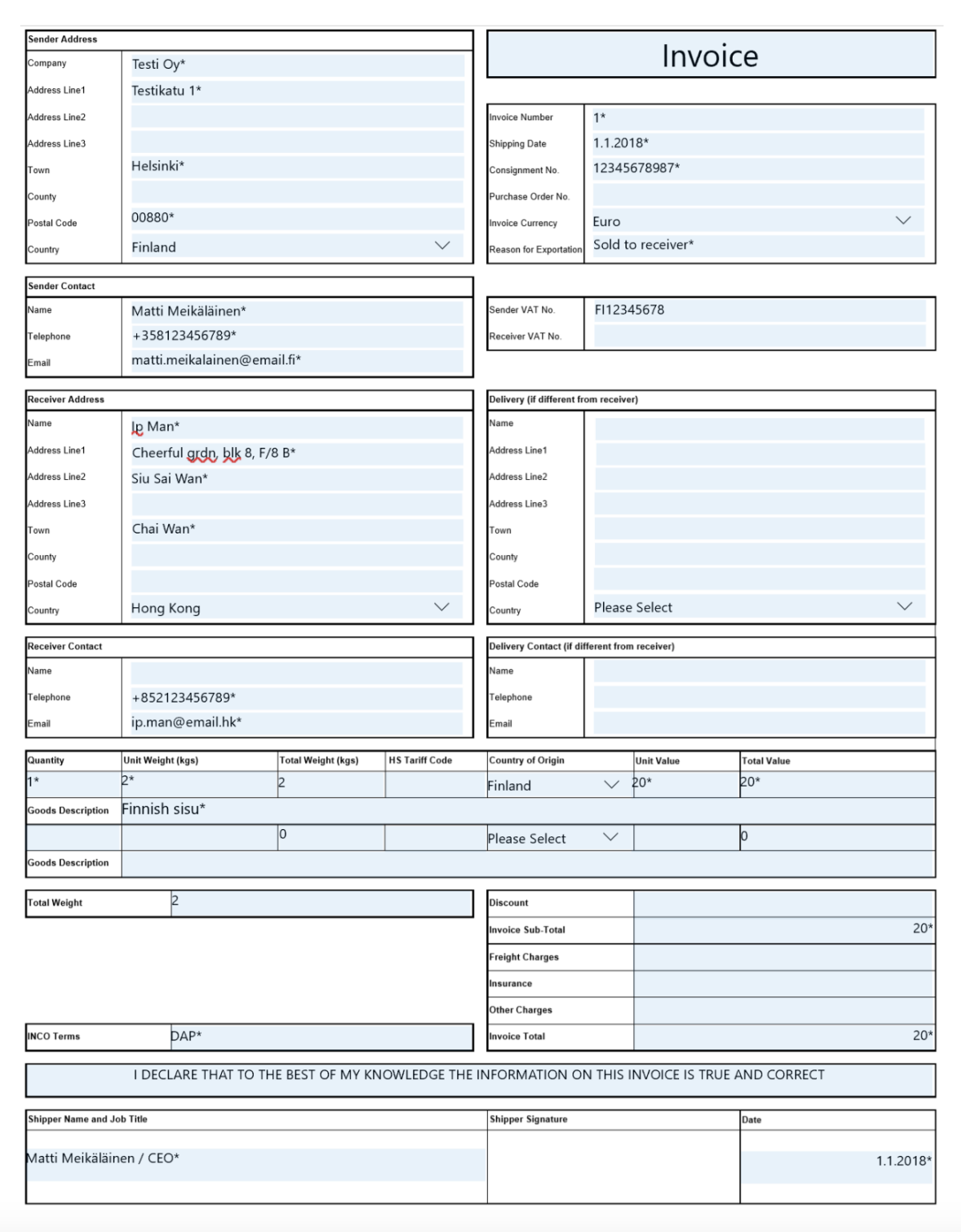

A commercial invoice is used when the shipment has been sold to the recipient and the products have commercial value. TARIC code is not required when the recipient is a private individual, however, these should be checked if there are limited products or similar products have restrictions at the destination to ensure smooth delivery. You can create a commercial invoice directly on Shipit's website when creating a shipment, you can also (NOTE: REMEMBER TO PRESS SAVE INVOICE AND PRINT INVOICE IF USING THIS TEMPLATE) download the commercial invoice template here

The following information is mandatory on commercial invoices

Sender's name, address, and contact information

Type of shipment (e.g., sold to receiver)

Description of goods

Quantity of goods

Value of goods

Currency

Country of origin (where the shipment was manufactured)

Incoterms (e.g., DAP)

Recipient's name, address, and contact information

Date of sale

Sender's signature and printed name

Add one copy of the commercial invoice inside the package and one on the outside. Also check carrier-specific settings

TARIC code (HS-Tariff code) is not mandatory in all cases, but for freight shipments, it's good to include it to prevent possible import issues and incorrect customs clearances.

It's also good to include the shipment number and the shipping company being used on the commercial invoice.

Example of a completed commercial invoice

Proforma Invoice

A proforma invoice is used when goods have no commercial value, i.e., goods have not been sold to the recipient (e.g., gift, return, or item being sent for repair). For proforma invoices, you can use phrases like No commercial value, Left behind luggage or for repair cases For customs purpose only. And please note that a value must be marked, 0 € does not work as a value in customs documents. The sender must be very precise and clearly state the purpose for which the shipment is being sent.

A proforma invoice is also used for personal moving goods and forgotten or separately sent luggage. Read more guidance and about personal shipments here.

HS-Tariff code is not mandatory for shipments where the recipient is private except in freight traffic, however for personal moving goods you can use code 9905000000 which defines the shipment type for customs and helps avoid unnecessary costs that might occur if the shipment type is not specified. We recommend checking TARIC codes (HS-Tariff codes) from customs especially if there are restrictions for similar products at the destination to ensure smooth import. We recommend calling customs but you can also try to find the codes here.

Proforma shipments may also be subject to local customs duties or VAT, depending on the value of the products and the purpose for which they are being sent. Personal luggage and moving goods are usually exempt from VAT and customs duties.

You can easily create a proforma invoice when making an order on Shipit's website by filling in a few additional fields.